Holiday time comes with mixed emotions for everyone. Especially, when you have an unexpected home or business fire, wind or weather tragedy, mechanical failure, or mishap. Many times, a homeowner or business owner will try to handle repairs and restoration projects on their own. Other times, fire, and smoke damage is too great leading you to file a residential or commercial insurance claim around the holidays. Only to find out, working with your insurance company is not what you expected. In this case, insurance claim public adjusters at Landmark are here to help during the holidays.

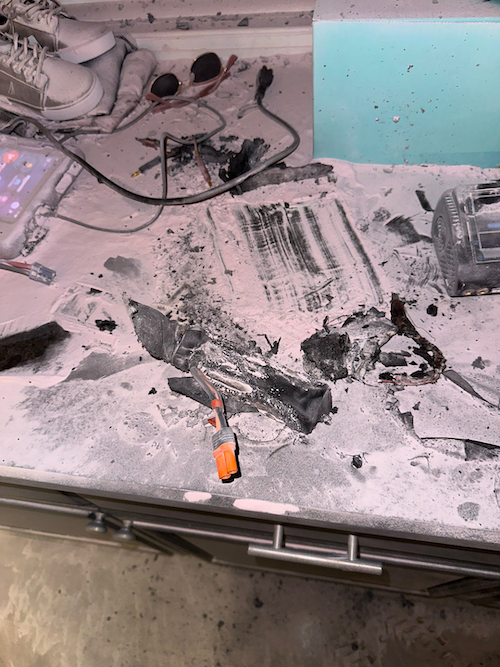

Landmark Public Adjusters in New York and New Jersey represent homeowners and commercial business owners when the unexpected happens. Whether it’s smoke damage due to a kitchen stove, candle or lithium-ion battery heat transfer, or oil burner puff backs causing an actual fire, filing an insurance claim may be necessary. Residential and commercial kitchen fires are more common during the holidays. The holidays are an incredibly busy time for many families. Accidents are bound to happen.

In-Depth Inspections By Insurance Claim Public Adjusters

The holidays are a festive time, but sometimes unexpected events put a damper on celebrations and spending. Simple things like using scented candles for happy occasions and enhanced ambience cause fire and smoke damage. Defective and poor-quality wax candles produce more smoke and higher flames leading to house fires. Open flames can ignite window treatments, furniture, kitchen cabinetry and more causing fire and smoke public adjusters to do a whole house inspection. Insurance claim public adjusters at Landmark Public Adjustments offer an independent analysis of all damages. Public adjusters settle insurance claims fairly on your behalf.

No one wants to face higher insurance premiums by putting in an insurance claim. However, the reality is policy premiums are up. The insurance industry is in a major transition given the number of storms alone all around the country. That’s where Landmark Public Adjusters steps in to help you navigate through all the nuances of your New York and New Jersey insurance policy. Be cautious in waiving away your rights to a public adjuster on insurance policies. Certain sections of insurance policies may stipulate any rights or limitations to representation or litigation.

Insurance Policy Details & Language

When fires and smoke damage, unexpected weather events happen, or pipes bursts due to cold weather it affects your personal life or workplace. Getting back on track, finding the right contractors to repair damage, and obtaining insurance settlements is a full-time job in most cases. Hiring public adjuster services takes all the guess work out of managing an insurance claim submission. The last thing you want to do is read the fine print and very confusing or difficult to understand verbiage on your insurance policy. Landmark insurance adjusters are experts when it comes to working with insurance carriers and coverage. Know your rights and understand what’s covered even before you submit an insurance claim on Long Island, NY, Manhattan, and Western New York.

The weather poses problems with cold weather, snow, and ice for New Yorkers and New Jerseyans. Lithium-ion battery explosions are rare but on the rise with Power Bikes, eBikes, and electric scooters. Lithium batteries are not meant to charge below freezing temperatures. While it might sound like a good idea for kids to charge their electric bicycles during winter and get some fresh air, battery hazards can happen leading to explosions, smoke and fire damage.

If you have no other choice but to submit an insurance claim, Landmark Public Adjustments will advocate for you making sure you receive fair insurance claim reimbursement, quality repairs, and comfortable temporary housing, if necessary, from start to finish. Your comfort and ability to enjoy time with your family is of utmost importance to us here at Landmark.